Net profit margin formula

So if you paid 10000 for goods and sold them for 12000 your gross profit would come to 2000. Gross profit margin and net profit margin are two profitability ratios used to assess a companys financial stability and overall profitability.

Profitability Ratios Personal Finance Organization Financial Management Managing Finances

Net profit margin is calculated by dividing net profits revenue minus expenses by total revenue then multiplying by 100 to convert it into a.

. To calculate net income you simply take the operating income EBIT and deduct. Net Profit Margin Net Profit Revenue x 100 However in order to use this net profit margin formula youll need to know how to work out net profit. Net margin also called net profit margin measures how much profit or net income is earned as a percentage of overall revenue.

The net profit margin is calculated by dividing the net profit by the total revenue. The net profit margin formula is as follows. The net profit margin formula is as follows.

The net profit margin formula or profitability of sales is a ratio that describes how much profit a company gets from its total revenue. Net margin is a ratio that is typically. Gross profit margin and net profit margin.

Net profit margin formula. Gross Profit Margin Gross Profit Revenue x 100 Operating Profit Margin Operating Profit Revenue x 100 Net Profit. Net Margin Formula Net Profit Margin Net Income Revenue To adjust the value into percentage form youd need to multiply the value by 100.

It is completely different from. Net profit margin Net income Revenue 100 Net income NI Net income determines what business is left over after paying all expenses through a period. Fortunately theres a net profit formula.

Apples gross profit margin for. 03 x 100 30 net profit margin If you currently have a sales mix meaning you sell multiple. Gross Profit Margin Net Sales Cost of Goods Sold Net Sales x 100.

The net profit margin is calculated using the following formula. Below is a breakdown of each profit margin formula. Net Profit Gross Income - Total Expenses The business expenses to be deducted include the cost of goods sold interest expense on loans and other debts income tax.

Net Profit Margin Net Income Revenue. This will give you the percentage of how much of the income is left over after all expenses are. It is a percentage of sales that is left after.

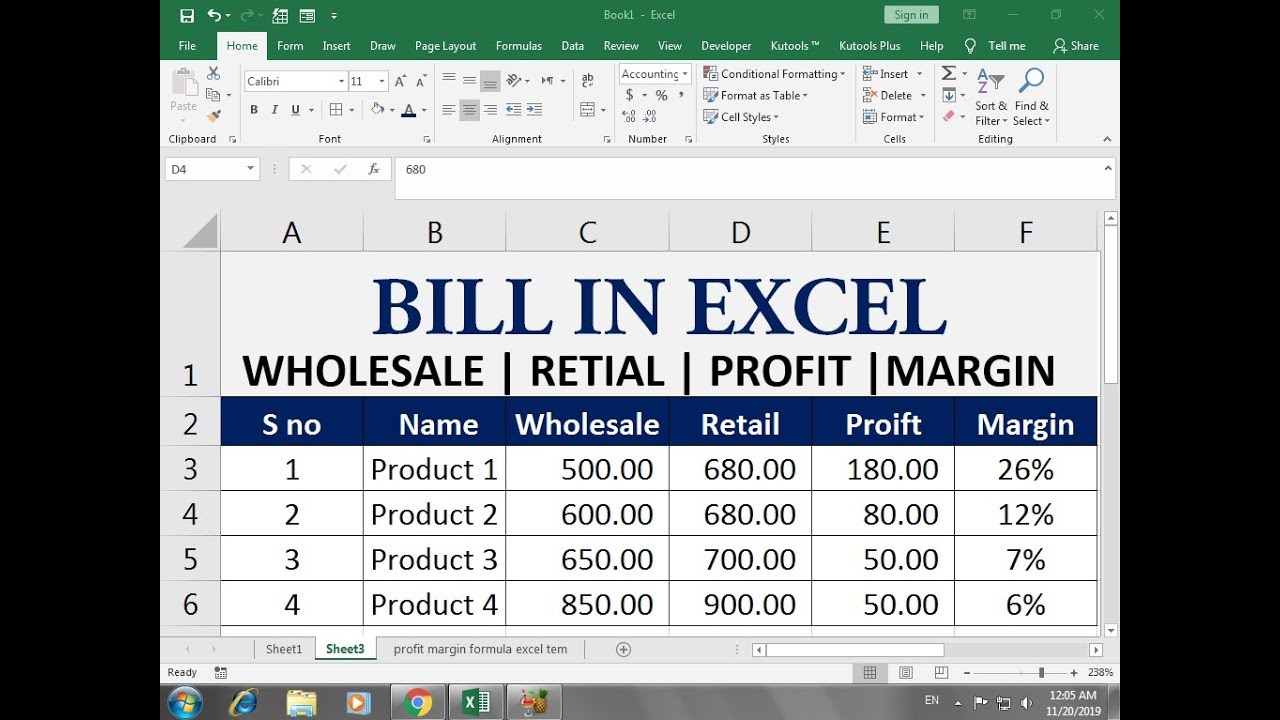

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

Genevieve Wood I Picked This Diagram Because Of The Side By Side View Of The Contribution Margin And Traditional Income Statement I Felt Like You Can Easily S

The Difference Between Gross Profit Margin And Net Profit Margin Net Profit Profit Company Financials

Net Income Formula Calculation And Example Net Income Accounting Education Income

Net Profit On Sales Accounting Play Accounting Basics Bookkeeping Business Accounting And Finance

Techwalla Com How To Calculate Gross Profit Margin Using Excel Techwallacom B07bd92b Resumesample Resumefor Excel Gross Margin Calculator

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel

Formula For Net Profit Margin In 2022 Net Profit Net Income Profit

Operating Profit Margin Or Ebit Margin Profit Meant To Be Interpretation

Net Profit On Sales Accounting Play Accounting Basics Bookkeeping Business Accounting And Finance

Return On Assets Managed Roam Return On Assets Asset Financial Management

How To Calculate Gross Profit Margin 8 Steps With Pictures Profit Profitable Business Cost Of Goods Sold

Pin On Storage

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

General Ledger Accounting Play General Ledger Accounting General Ledger Example

I Found This Formulae Very Helpful It Shoes Four Different Ways Of Calculating Degree Of Operating Leverage Also It Breaks Down Contribution Margin Sales Var

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infograph Financial Literacy Lessons Economics Lessons Finance Education